This money covers the initial setup of the account and it contains storage and insurance coverage of gold. Birch Gold Group is a California-primarily based brokerage agency that makes a speciality of gold and different treasured metals. Do Any Of those Gold IRA Companies Provide Bitcoin IRAs? Nonetheless, employees lament the falling value of their salaries, as the value of gold has steadily risen on the world market. There are not any 10 best gold IRA companies. The very best IRA accounts, together with the most effective Roth IRA accounts, are powerful funding automobiles to construct lengthy-lasting wealth. Wide selection of Options: Charles Schwab gives a wide range of retirement accounts, together with Conventional IRAs, Roth IRAs, SEP IRAs and Simple IRAs, in addition to personal selection retirement accounts (PCRA) that permit for a more hands-on investment method. The brokerage additionally offers several other retirement accounts, including Roth IRAs, rollover IRAs, small business retirement plans, and Roth IRAs for youths. For employer-sponsored retirement plans, you can contribute an extra $7,500 if you are 50 or older. In contrast to 401(okay)s and different employer-sponsored retirement plans, IRAs – or individual retirement accounts – may be arrange by individuals over 18 with taxable revenue. You’ll need at the very least $500 to set up this account. What to look out for: Goldco requires a $25,000 minimal to open an account.

This money covers the initial setup of the account and it contains storage and insurance coverage of gold. Birch Gold Group is a California-primarily based brokerage agency that makes a speciality of gold and different treasured metals. Do Any Of those Gold IRA Companies Provide Bitcoin IRAs? Nonetheless, employees lament the falling value of their salaries, as the value of gold has steadily risen on the world market. There are not any 10 best gold IRA companies. The very best IRA accounts, together with the most effective Roth IRA accounts, are powerful funding automobiles to construct lengthy-lasting wealth. Wide selection of Options: Charles Schwab gives a wide range of retirement accounts, together with Conventional IRAs, Roth IRAs, SEP IRAs and Simple IRAs, in addition to personal selection retirement accounts (PCRA) that permit for a more hands-on investment method. The brokerage additionally offers several other retirement accounts, including Roth IRAs, rollover IRAs, small business retirement plans, and Roth IRAs for youths. For employer-sponsored retirement plans, you can contribute an extra $7,500 if you are 50 or older. In contrast to 401(okay)s and different employer-sponsored retirement plans, IRAs – or individual retirement accounts – may be arrange by individuals over 18 with taxable revenue. You’ll need at the very least $500 to set up this account. What to look out for: Goldco requires a $25,000 minimal to open an account.

I’m not aware what number of valuable metals investors took benefit of this supply, however it’s the perfect one I may discover. It’s a minor nitpick of mine however I’m mentioning it right here regardless. Learn the full Birch Gold Group overview here. Nonetheless, if you’re looking for a Bitcoin IRA firm, then you possibly can read my information to the very best Bitcoin IRA firms subsequent. I haven’t talked a lot about JM Bullion in this submit, but read my JM Bullion review and information to be taught every thing you’ll want to find out about this company. American Numismatic Association. Read my full Advantage Gold overview here. A big advantage of opening an IRA consists of an above-the-line tax deduction if you are within the IRS income limitations for 2021 (ask your tax skilled or financial advisor to double examine primarily based in your income). If you liked this article and you would like to receive more info pertaining to best gold ira accounts please visit our own web-page. In a conventional IRA, Best Gold Ira Accounts the money grows tax deferred. Here’s a calculation of how much it’d cost you to return the precious metals you purchased and get your money back, sans the gold IRA company unfold.

I’m not aware what number of valuable metals investors took benefit of this supply, however it’s the perfect one I may discover. It’s a minor nitpick of mine however I’m mentioning it right here regardless. Learn the full Birch Gold Group overview here. Nonetheless, if you’re looking for a Bitcoin IRA firm, then you possibly can read my information to the very best Bitcoin IRA firms subsequent. I haven’t talked a lot about JM Bullion in this submit, but read my JM Bullion review and information to be taught every thing you’ll want to find out about this company. American Numismatic Association. Read my full Advantage Gold overview here. A big advantage of opening an IRA consists of an above-the-line tax deduction if you are within the IRS income limitations for 2021 (ask your tax skilled or financial advisor to double examine primarily based in your income). If you liked this article and you would like to receive more info pertaining to best gold ira accounts please visit our own web-page. In a conventional IRA, Best Gold Ira Accounts the money grows tax deferred. Here’s a calculation of how much it’d cost you to return the precious metals you purchased and get your money back, sans the gold IRA company unfold.

Funding Decisions: Shoppers can select from a broad array of investment options, similar to stocks, bonds, ETFs, mutual funds and extra, which allows customized retirement planning primarily based on particular person threat tolerance and retirement targets. You possibly can access no-transaction-payment funds, fee-free stocks and ETFs, and zero-expense ratio index funds. 0 on-line fairness trades, 24/7 customer assist, Best gold Ira accounts retirement planning assets, and entry to the next investments: stocks, bonds, ETFs, mutual funds, and CDs. They’ve 24/7 customer service support, a versatile payment structure, and a large number of valuable metals you can buy. The corporate gives certified financial planners, and it even offers Stock Bits, or fractional shares, for account holders wanting to purchase smaller parts of companies. Or you can buy larger quantities. Solely U.S. storage. If you’re from Canada you are able to do enterprise with Noble Gold, however your precious metals will be stored in one of many USA-primarily based IRA-authorized depositories.

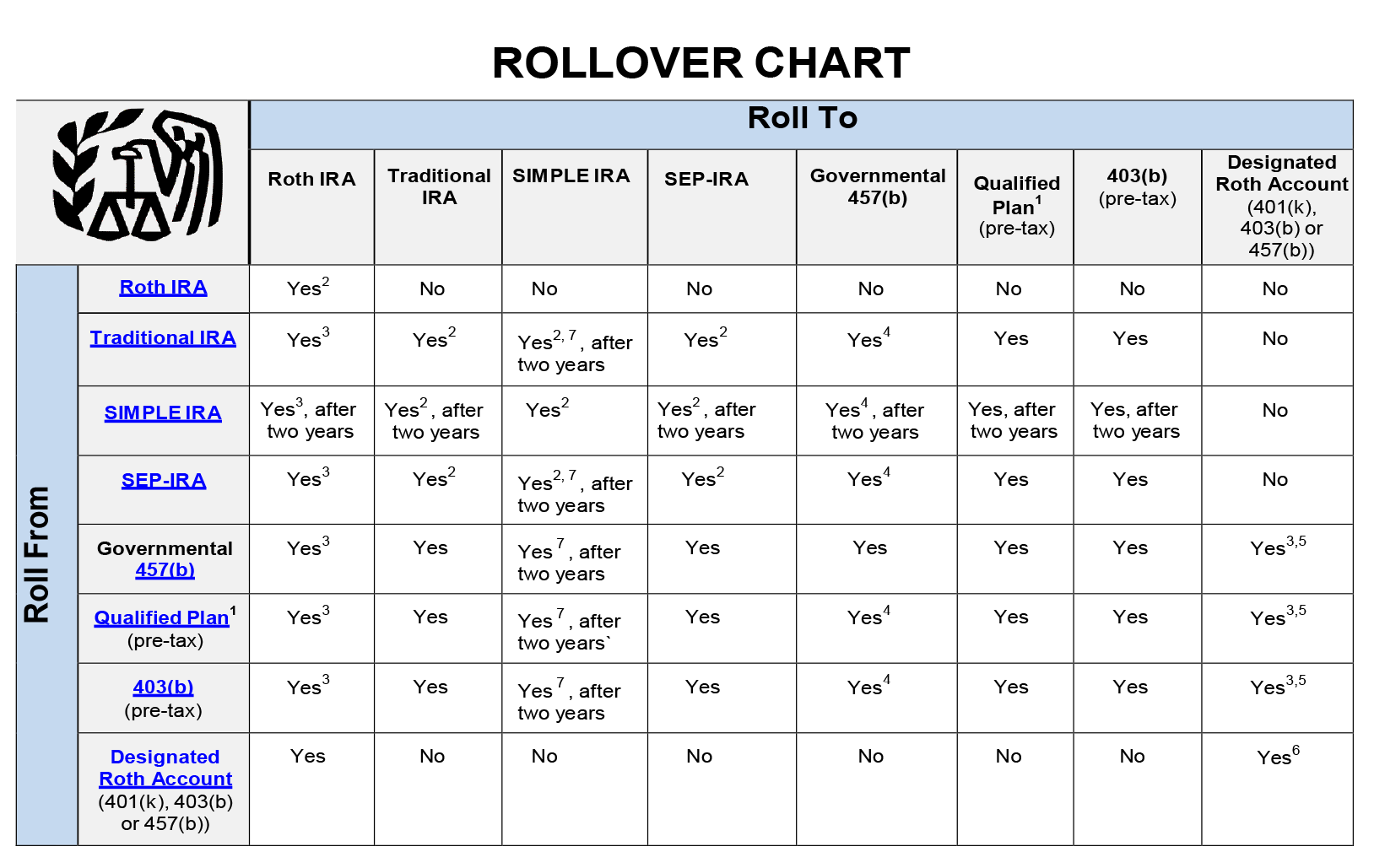

One other method is to see if your gold floats. See IRA Contribution Limits and IRA deduction limits. Funding the Account: You possibly can fund your Gold IRA by rolling over or doing a direct transfer of funds from an present IRA or 401(okay), or by making contributions directly to the account, subject to IRS contribution limits. In case your account exceeds $25,000, you may be topic to an annual 0.35% management fee. Required (RMDs) and Non Required Distributions: Like traditional IRAs, distributions from a Gold IRA are subject to IRS guidelines and regulations. A number of IRA guidelines give restrictions on the cash contributions even if the IRS allows you to contribute in a most amount. Many traders want to diversify their traditional IRA investments by switching to a self-directed retirement account that permits you to exchange and trade in bodily gold and silver. The investments inside an IRA are chosen by the account proprietor. Primarily based on my analysis the primary custodian all silver IRA companies really helpful are Fairness Belief. Ease of account setup- IRA companies that make account setup seamless are higher, particularly for brand spanking new buyers. Birch Gold Group supply free silver coins on certified gold purchases.

Birch Gold Group- no refunds, except for counterfeit coins returned to their authentic holders within 90 days of buy. So there isn’t much demand for rhodium coins and bullion on the market. Buyback coverage- Some silver IRA firms don’t have buyback insurance policies. A conventional IRA generally provides better flexibility, freedom, and transparency than a 401(okay). If you are underneath earnings phaseout limits, then there’s a tax-deduction for IRA contributions. Whereas it’s true it’s inevitable that the economic situation will worsen sometime sooner or later (it can’t always be bettering in perpetuity), their messaging implies it’s going to happen really soon so that you higher open a gold IRA account with them. The rationale I did this is because if a gold IRA company doesn’t take good care of their web site (storefront), then they won’t take good care of you as their buyer and you’re higher off trusting them with your savings and investments. That’s essential, particularly for brand new traders who’re usually half-scared to invest their financial savings into precious metals and who don’t want one other hurdle to get over. Beneath is my article’s FAQ part where I cover all the questions I found people have about precious metals IRA companies. The gold IRA companies that don’t have particular promotions throughout BFCM are Augusta Treasured Metals, American Hartford Gold and Noble Gold. However, I was capable of finding that they cost $215.80 worth premium per oz. over COMEX. The robo-advisor affords two plans: Digital and Premium.